Anhand der Methodik der Nutzwertanalyse soll exemplarisch gezeigt werden, wie im Rahmen des strategischen Managements Entscheidungen für oder gegen Digitalisierung von Geschäftsprozessen getroffen und umgesetzt werden können. Dazu wird das Anwendungsbeispiel der Rechnungseingangsprüfung genutzt, wobei der Status quo der manuellen Rechnungseingangsprüfung mittels einer Nutzwertanalyse der automatisierten elektronischen Verarbeitung gegenübergestellt wird. Das Ergebnis der Nutzwertanalyse soll Antwort auf die Frage geben, ob und wie sich der Prozess der Eingangsrechnungsverarbeitung papierlos und effizient auf elektronische Weise gestalten lässt.

Entscheidungsfindung durch Nutzwertanalyse: Notwendigkeit einer Prozess-Digitalisierung

Die Einführung der elektronischen Rechnungsverarbeitung geht mit einer weitreichenden Änderung bestehender Strukturen, Prozesse und Tätigkeitsfelder einher, die ein geeignetes Change-Management erfordern. Die Nutzwertanalyse ist ein passendes Instrument, das einerseits den Zusatznutzen einer Alternative darstellt und andererseits abteilungsübergreifend alle von einer Veränderung betroffenen Mitarbeiter von Beginn an mitnimmt. Insbesondere dadurch, dass mehrere Akteure in den Entscheidungsprozess involviert sind, ist die Methode objektiv und die damit herbeigeführte Entscheidung ermöglicht hohe Akzeptanz. Insofern bietet die Nutzwertanalyse ein geeignetes Instrument zur partizipativen, gemeinsamen, objektiven Entscheidungsfindung und sichert damit Commitment für die Umsetzung der Entscheidung.

Funktionsweise der Nutzwertanalyse

Die Nutzwertanalyse fokussiert nicht nur auf monetäre Aspekte, sondern insbesondere auf den funktionalen Nutzen. Im Rahmen einer Entscheidungsvorbereitung dient sie zur Beurteilung und lässt dabei die Berücksichtigung sowohl quantitativer als auch qualitativer Kriterien zu. Besonders hervorzuheben ist das analytische und systematische Vorgehen, sodass sie insbesondere bei der Lösung vielschichtiger Entscheidungsprobleme Anwendung findet.

Herleiten von Vergleichskriterien

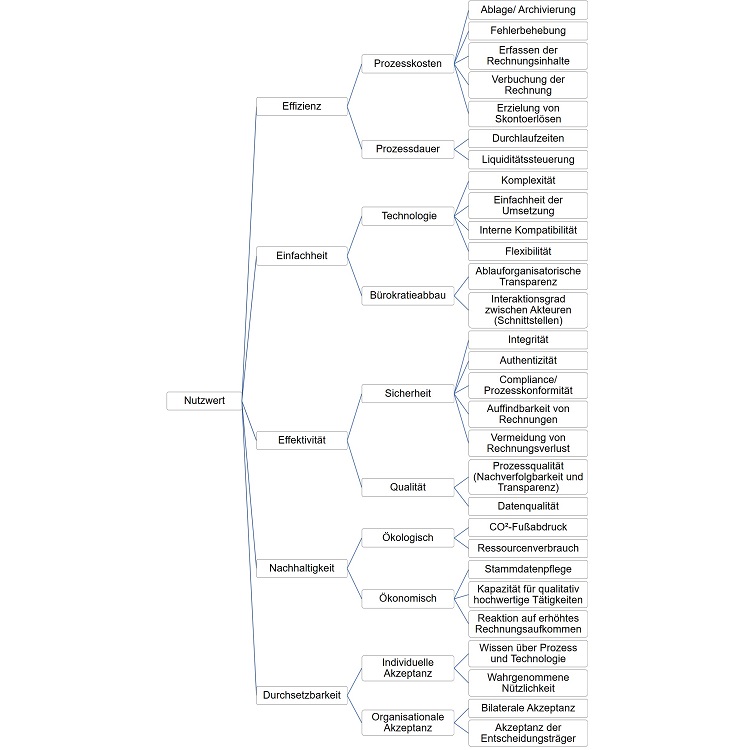

Im ersten Schritt der Nutzwertanalyse werden die bei der Bewertung zu berücksichtigenden Kriterien ausgewählt und ein Zielsystem aufgestellt. Es wird empfohlen, die Zielstruktur stufenweise und hierarchisch aufzubauen, sodass übergeordnete Ziele bzw. Kriteriengruppen mithilfe von Unterzielen konkretisiert werden. Folgende Punkte sind dabei zu beachten:

- Vollständigkeit: Berücksichtigung sämtlicher quantitativer und qualitativer Kriterien, die Einfluss auf den Nutzen nehmen

- Überschneidungsfreiheit: gleichartige Ziele sind zusammenzufassen

- Präferenzunabhängigkeit: es darf keine Abhängigkeit zwischen den Zielen bestehen

- Überschaubarkeit: Berücksichtigung von maximal sieben Kriterien

- Vermeidung von „Muss-Zielen“: deren Erfüllung ist Grundvoraussetzung

- Anwendbarkeit der Kriterien: müssen auf Status quo und Alternative angepasst sein

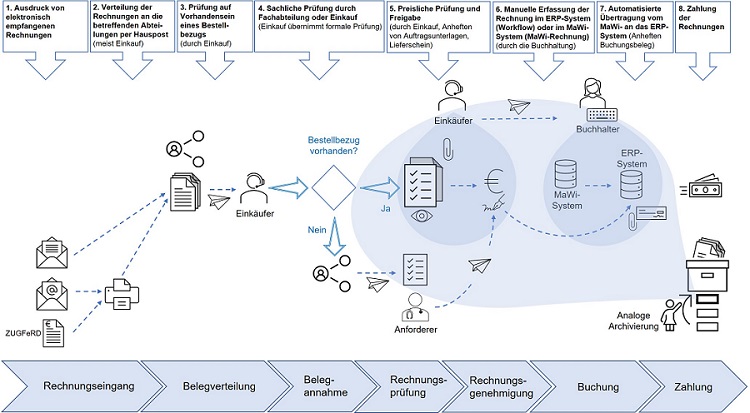

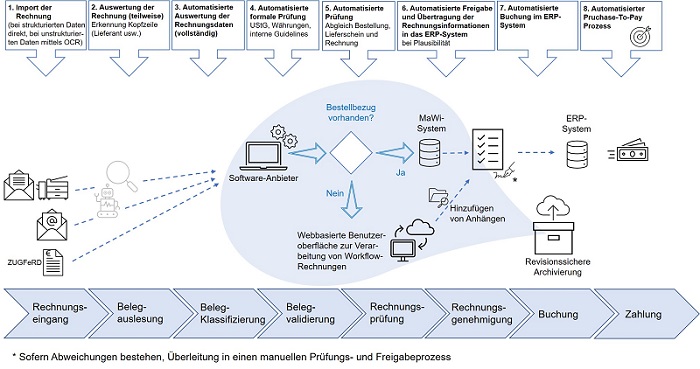

Die für die Nutzwertanalyse zu berücksichtigenden Kriterien lassen sich aus der Problemstellung, den Unterschieden sowie den Vor- und Nachteilen der analogen und elektronischen Rechnungsverarbeitung ableiten (siehe die beiden obigen Abbildungen). Für die Rechnungsverarbeitung ergeben sich fünf übergeordnete Ziele, deren Nutzen sich wiederum aus Unterzielen zusammensetzt. Diese sind Effizienz, Einfachheit, Effektivität, Nachhaltigkeit und Durchsetzbarkeit.

Effizienz

Effizienz hat zwei Ausprägungen. Zum einen zeigt sie sich in den Prozesskosten und zum anderen in der Prozessdauer.

Unter den Gesichtspunkt der Prozesskosten fallen

- Effizienz von Ablage und Archivierung.

- Aufwand für Auslesen und Erfassen der Rechnungsinhalte

- Aufwand für die formale und sachliche Prüfung einer Rechnung

- Möglichkeit zur Erzielung von Skontoerträgen

- Aufwand für Fehlerbehebung.

In Bezug auf die Prozessdauer lassen sich für den Effizienzvergleich zwei wesentliche Kriterien herausarbeiten:

- Durchlaufzeit einer Rechnung

- Möglichkeiten zur Liquiditätssteuerung.

Eng mit dem Kostenaspekt entgangener Skontoerträge verbunden ist die Möglichkeit, die Liquidität gezielt zu steuern. Dies ist nur möglich, wenn ein Überblick über alle offenen Rechnungen jederzeit möglich ist. Einfluss auf den Zeitpunkt der Begleichung einer Rechnung kann zudem nur genommen werden, wenn nach der Freigabe einer Rechnung noch ausreichend Zeit bis zum Zahlungsziel verbleibt, weshalb der Aspekt der Liquiditätssteuerung unter dem übergeordneten Ziel der Prozessdauer eingeordnet werden kann.

Einfachheit

Das Kriterium der Einfachheit lässt sich in eine technologische und eine bürokratische Dimension gliedern. Unter den technologischen Gesichtspunkt fallen neben der internen Kompatibilität die Einfachheit der Umsetzung sowie Flexibilität wie Komplexität. Flexibilität bezieht sich dabei auf das Customizing der Softwarelösung und die kurzfristige Anpassungsfähigkeit bei Veränderungen. Sind Softwarelösungen stark fragmentiert, so gestaltet sich die technische Umsetzung schwierig. Je mehr Schnittstellen bestehen, desto komplexer ist die Umsetzung. Unter interner Kompatibilität versteht man die über den Kernnutzen einer Lösung hinausgehenden zusätzlichen Funktionen, wie beispielsweise die Möglichkeit, Auswertungen zu erstellen. Das Kriterium der technologischen Einfachheit beschreibt beispielsweise die Ergonomie der Benutzeroberfläche.

Der auf den Bürokratieabbau bezogene Teil der Einfachheit zeigt sich im Interaktionsgrad der Akteure. Je weniger Personen in einen Prozess involviert sind, desto weniger Schnittstellen bestehen und desto unbürokratischer ist das Vorgehen. Zum anderen wirkt sich auch die ablauforganisatorische Transparenz direkt auf den Bürokratieabbau aus.

Effektivität

Das Kriterium der Effektivität hat zwei Aspekte: Sicherheit und Qualität. Das Ziel der Sicherheit konkretisiert sich in den Möglichkeiten zur Prozessumgehung, der Auffindbarkeit von Rechnungen sowie der Vermeidung von Rechnungsverlust und Datenmanipulation.

Der qualitative Charakter der Effektivität zeigt sich in der Prozess- und Datenqualität. Prozessqualität umfasst dabei die Kriterien Nachverfolgbarkeit und Transparenz. Beim elektronischen Prozess sind diese dadurch erfüllt, dass jeder Bearbeitungsschritt in einer Genehmigungs- bzw. Beleghistorie dokumentiert ist und jederzeit transparent ist, an welcher Stelle eine Rechnung zur Bearbeitung liegt. Unter dem Aspekt der Datenqualität werden Rechnungsfehler und Eingabefehler zusammengefasst. Gerade bei repetitiven Erfassungsaufgaben zeigen sich die Vorteile einer automatisierten Lösung, denn diese produziert wesentlich weniger Fehler.

Sustainability

Das vierte übergeordnete Kriterium der Nachhaltigkeit hat wiederum zwei Komponenten. Ökologische Nachhaltigkeit beinhaltet dabei den ökologischen Fußabdruck in Form von Emissionen und Ressourcenverbrauch. Der elektronische Versand und die digitale Verarbeitung unterstützen dabei die Reduktion der Emissionen sowohl durch den elektronischen Versand als auch durch die wegfallende Produktion des Papierbelegs selbst.

The wirtschaftliche Nachhaltigkeitsaspekt zeigt sich in den Möglichkeiten der Stammdatenpflege, der Reaktionsfähigkeit auf ein erhöhtes Rechnungsaufkommen sowie der Kapazität für höherwertige Tätigkeiten der im Prozess beteiligten Mitarbeiter. Die Qualität der Stammdaten hat direkten Einfluss auf die Dauer der Rechnungsprüfung. Je besser die Qualität, desto weniger Abweichungen und desto weniger manueller Korrekturaufwand entsteht. Ökonomisch nachhaltig zu handeln bedeutet aber nicht nur, für eine kontinuierlich besser werdende Stammdatenqualität zu sorgen, sondern auch vorhandene Ressourcen dort einzusetzen, wo sie am meisten Nutzen stiften. Im Falle der manuellen Rechnungsverarbeitung ist im untersuchten Unternehmen eine Vollzeitkraft zu fast hundert Prozent mit repetitiven Aufgaben wie der Erfassung von Rechnungsinhalten beschäftigt. Die Zeit, qualitativ hochwertigere und für die Mitarbeiter sinnstiftende Aufgaben zu erledigen, besteht nicht. Übernimmt beispielsweise ein Roboter diese Tätigkeit, so könnte der Mitarbeiter mehr Zeit für andere, wertschöpfende Tätigkeiten aufbringen. Ein weiterer Aspekt ist das Reaktionsvermögen bei einem höheren Rechnungsvolumen. Bei der elektronischen Rechnungsverarbeitung können temporäre Spitzen ebenso wie eine dauerhafte Erhöhung des Rechnungsaufkommens problemlos ausgeglichen werden.

Durchsetzbarkeit

Die letzte Zielkategorie stellt die Durchsetzbarkeit dar, die in individueller und organisationaler Akzeptanz zum Ausdruck kommt. Unter letzterer versteht man die Akzeptanz der Entscheidungsträger und Geschäftspartner. Insbesondere große Lieferanten haben ein Eigeninteresse am elektronischen Versand und der digitalen Verarbeitung der Rechnungen, da sie sich einerseits Porto sparen und andererseits auf eine fristgerechte Bezahlung der Rechnung hoffen. Auf Leitungsebene ist bei der digitalen Rechnungsverarbeitung von einer höheren Akzeptanz auszugehen, da sich das Management insbesondere an ökonomischen Gesichtspunkten orientiert.

Die Akzeptanz auf der individuellen Ebene der Sachbearbeiter fällt geringer aus als die Akzeptanz der Führungskräfte. Die Einführung der elektronischen Rechnungsverarbeitung macht eine Transferleistung in der Finanzbuchhaltung notwendig und erfordert von den Mitarbeitern einen Kompetenzaufbau im Sinne von Prozesskenntnis und technologischen Verständnis.

Durchführung der Nutzwertanalyse

Die Grundlage für die Durchführung der Nutzwertanalyse ist die Herleitung geeigneter Vergleichskriterien. Die darauffolgenden Schritte der Gewichtung und Bewertung sind von starker Subjektivität geprägt, sodass es sich empfiehlt, diese im Team vorzunehmen. Dadurch wird nicht nur Objektivität gefördert, sondern auch die Akzeptanz der herbeigeführten Entscheidung unterstützt. Parallel können Instrumente wie der paarweise Vergleich helfen, eine sinnvolle Gewichtung zu wählen.

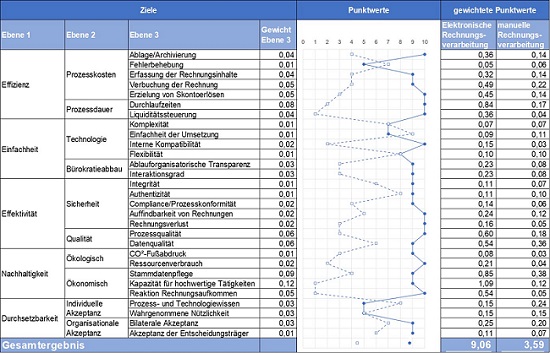

Die nachfolgende Abbildung zeigt anhand einer Profildarstellung exemplarisch ein potenzielles Ergebnis einer Nutzwertanalyse zur Rechnungsverarbeitung. Liegen die Punktwerte der Alternativen näher beieinander, empfiehlt sich die Entwicklung verschiedener Szenarien, indem beispielsweise Gewichtungen variiert werden. Nur wenn das Ergebnis der Nutzwertanalyse auch bei leichter Variation der Gewichtung zum gleichen Ergebnis führt, ist dieses valide.

Conclusion

Die Nutzwertanalyse ist ein geeignetes Instrument, um den Status quo hinsichtlich dessen qualitativen Nutzens mit der automatisierten Verarbeitung zu vergleichen und damit eine strategische Managemententscheidung zu begründen. Indem die Nutzwertanalyse als gemeinsames partizipatives Vorgehen zwischen allen am Prozess beteiligten Akteuren durchgeführt wird, erweist sie sich insbesondere im Kontext langjährig bewährter Settings und routinierter Prozesse als besonders geeignet. Die Nutzwertanalyse kann helfen, Akzeptanz für Entscheidungen zur Digitalisierung von Prozessen zu schaffen.

Dieser Beitrag wurde von Stefanie Albrecht und Professor Dr. Peter Steinhoff gemeinsam verfasst. Stefanie Albrecht hat ihren Bachelor-Abschluss in Betriebswirtschaft im Gesundheitswesen an der Hochschule für angewandte Wissenschaften in Neu-Ulm absolviert. Aktuell arbeitet sie als Referentin im Einkauf einer Universitätsklinik und studiert im Master an der Hochschule für angewandtes Management in Ismaning mit Schwerpunkt International Accounting.

Literaturverzeichnis

Andler, N. (2015): Tools für Projektmanagement, Workshops und Consulting: Kompendium der wichtigsten Techniken und Methoden. 6. Aufl., Erlangen: Wiley

Bernius, S./Pfaff, D./Werres, S./König, W. (2013): Handlungsempfehlungen zur Umsetzung des elektronischen Rechnungsaustauschs mit der öffentlichen Verwaltung: Abschlussbericht des Projekts eRechnung. Online: https://www.ferd-net.de/upload/Handlungsempfehlungen-Rechnungsaustausch.pdf (Zugriff: 26.06.2020)

Bieg, H./Kußmaul, H./Waschbusch, G. (2016): Investition. 3. Aufl., Berlin: Franz Vahlen

Burghardt, M. (2013): Einführung in Projektmanagement: Definition, Planung, Kontrolle und Abschluss. 6. Aufl., Somerset: Publicis MCD Werbeagentur GmbH

Diehm, J./Benzinger, L. (2018): Digital Finance: Digitale Rechnungsverarbeitung und Workflows als Basis für ein Rechnungswesen 4.0. In: Der Betrieb (DB), 71 (15), S. 841-847

Koch, S. (2011): Einführung in das Management von Geschäftsprozessen: Six Sigma, Kaizen und TQM. Berlin/Heidelberg: Springer

Schömburg, H./Breitner, M. H. (2010): Elektronische Rechnungen zur Optimierung der Financial Supply Chain: Status Quo, empirische Ergebnisse und Akzeptanzprobleme. In: Schumann, M./Kolbe, L. M./Breitner, M. H./Frerichs, A. (Hrsg.): Tagungsband Multikonferenz Wirtschaftsinformatik (MKWI), 23.-25.02.2010, Göttingen, S. 1253-1264

Schön, D. (2018): Planung und Reporting Im BI-Gestützten Controlling: Grundlagen, Business Intelligence, Mobile BI und Big-Data-Analytics. 3. Aufl., Wiesbaden: Springer Gabler. in Springer Fachmedien Wiesbaden GmbH

Schulze, U. (2009): Informationstechnologieeinsatz im Supply Chain Management: Eine konzeptionelle und empirische Untersuchung zu Nutzenwirkungen und Nutzenmessung. In: Weber, J. (Hrsg.): Schriften des Kühne-Zentrums für Logistikmanagement, Bd. 10, Wiesbaden: Gabler

Svatopluk, A./Haisermann, A./Schabicki, T./Frank, S. (2018): Robotic Process Automation (RPA) im Rechnungswesen und Controlling – welche Chancen ergeben sich? In: Controlling (CON), 30 (3), S. 11-19

Vahs, D./Brem, A. (2015): Innovationsmanagement: Von der Idee zur erfolgreichen Vermarktung. 5. Aufl., Stuttgart: Schäffer Poeschel

Weber J./Schäffer, U. (2014): Einführung in das Controlling. 14. Aufl., Stuttgart: Schäffer Poeschel

(Coverbild: © makibestphoto | Adobe Stock)